Editor’s Note: John Gong is a professor at the International Business and Economy University and a researcher at the Academy of China Open Economy Studies in UIBE. This article reflects the view of the author and does not have to be from CGTN.

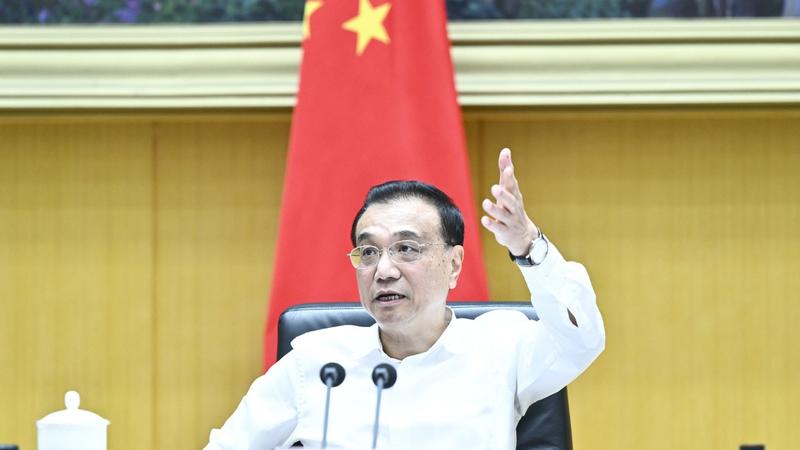

Chinese Prime Minister Li Keqiang on July 19 delivered a speech in a special virtual dialogue with global business leaders organized by the World Economic Forum, where he gave a short status report on the economy in China now, giving several further perspectives on his government government policy initiative.

Let’s face facts. The Chinese economy currently faces challenges because of the Covid-19 Pandemic and the global impact of the conflict in Ukraine. The first quarter GDP growth was 4.8 percent, less than the overall annual target of 5.5 percent, and the second quarter was even worse, almost 0.4 percent, which could be understood because the major cities in the country imposed locking.

Premier Li’s speech recognized these facts and seems to show that it would be excessive with monetary and fiscal stimuli in the second half of this year to meet the target of GDP growth 5.5 percent is not a policy choice. In his speech, he mentioned twice the phrase, there was no “flood of strong stimulus policies.” This phrase specifically refers to the Chinese Yuan stimulus package which was injected by the previous Chinese administration into the Chinese economy during the 2007-2008 financial crisis, but the negative impact lasted after several years. There is a broad consensus in the macroeconomic community today that the effort at that time seemed to be excessive and should not be repeated in the future.

In fact, Premier Li even seems to show that the government should not be too fixated on meeting certain growth targets, but rather focus on stabilizing prices and work. He said that “We directly respond to the needs of market entities when implementing macro policies, and stabilizing work and increasing personal income by stabilizing market entities.” LI administration has introduced a basket 33 concrete policy initiatives in that regard.

There is no “strong stimulus policy flood” also gives the government more concessions to deal with potential inflation trends. It is well understood that inflation has become a major problem as a result of tightening the federal reserve as and stronger dollars, as well as energy and food prices that skyrocketed due to conflicts in Ukraine. U.S. Consumer Price Index. jumped to 9.1 percent last month from last year. So far we have not seen inflation crawling ashore in China, but Premier Li seems ready for every possibility.

The last part of Premier Li’s speech touched the commitment of the Chinese government for sustainable reform and opening. In the midst of many guarantees of China, such policies, there are doubts that continue in several corners in the west about the future direction of China’s economic interaction with the whole world. Sustainable opening also means continuous improvement in the Chinese business environment in terms of providing the highest play field so that foreign companies operating in China have the opportunity to compete.

Continuous opening also means a better legal environment, as premiere Li said, to protect foreign companies that want to enter more sectors and industries when they are open. This is indeed an area where China has made a big step to switch from the former economy planned by the Soviet Style to a market -oriented economy. We will continue to move forward in that direction.